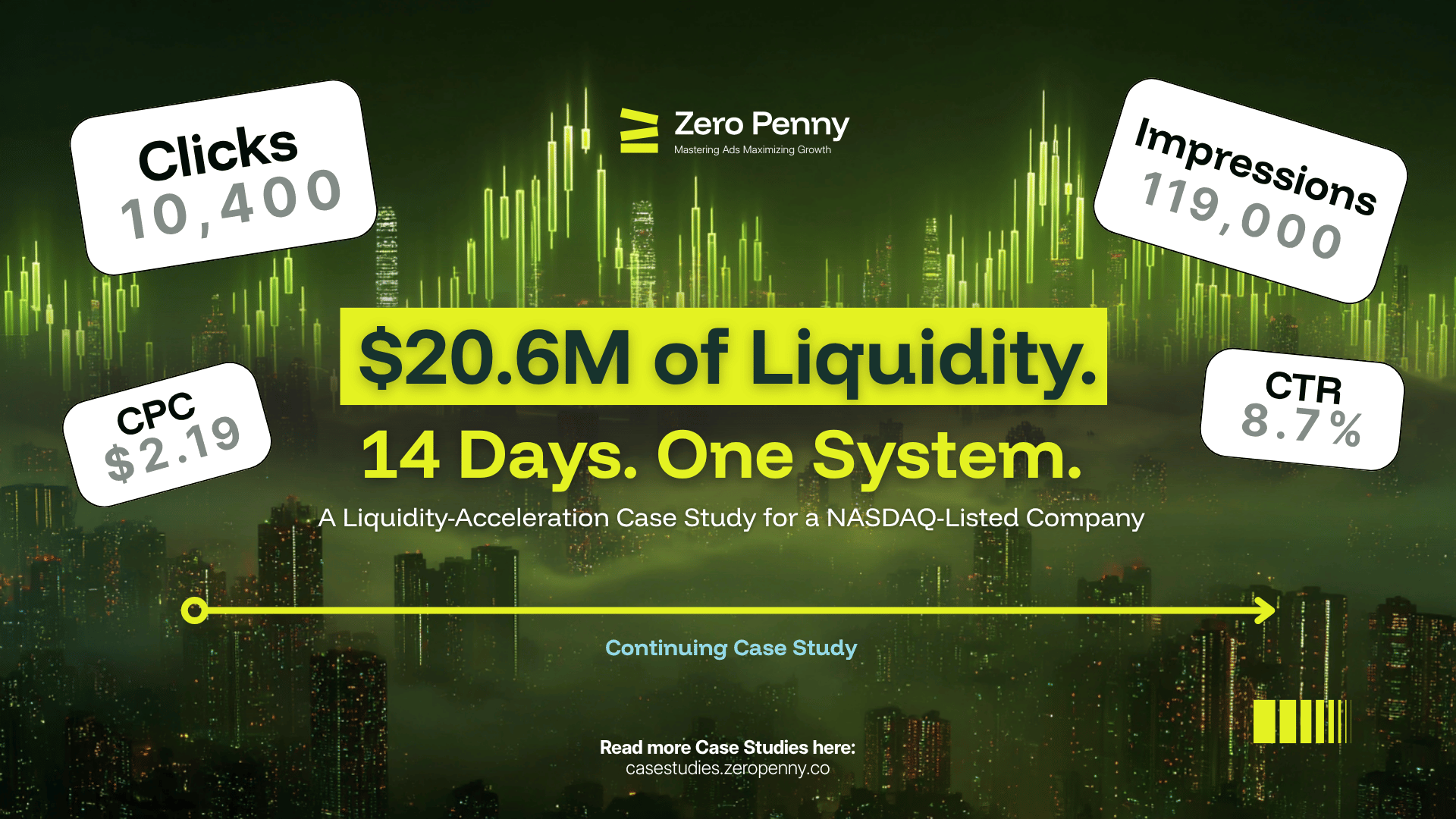

$20.6M of Liquidity. 14 Days. One System.

A Liquidity-Acceleration Case Study for a NASDAQ-Listed Company

TL;DR

10,400 investor-intent clicks via Google Search during live market hours

Impressions: 119,000

CTR: 8.7%

Avg CPC: $2.19

Ad Spend: $22,700

Trading Volume Generated: $20.6M

Primary HVAs: brokerage redirects • watchlist adds • ticker lookups

Campaign Context

A financial publishing client partnered with ZeroPenny to generate measurable investor engagement for a NASDAQ-listed company. We engineered the system around market-hours synchronization, search-intent precision, and attribution integrity — not hype.

Goal: Create verifiable investor attention that coincides with observable trading activity and increased liquidity — without speculative claims.

System Architecture

1) Timing: Market-Hours Synchronization

Delivery restricted to 9:00 AM – 4:00 PM EST to align with liquidity & ticker-search spikes

Smart pacing concentrated spend when intent density peaked

2) Query Architecture

Layered keywords: Ticker + Company + Competitor plus thematic finance queries

Exact/Phrase for high-signal investors; Broad + strict negatives for discovery and CPA control

Bid multipliers on “buy / forecast / earnings” clusters

3) Messaging Logic

“Signal + Proof + Disclosure” ads: fundamentals, filings, and recent news — no hype

Extensions to fundamentals • SEC filings • latest coverage

4) Bidding & Data Integrity

tCPA stabilized against volatility; no bid inflation during spikes

Server-side events + disciplined UTMs preserved measurement fidelity

5) Attribution Controls

Tracked HVAs: brokerage redirects • watchlist adds • ticker copy • session depth

Post-campaign alignment showed clear correlation between delivery windows and behavior spikes

Performance Snapshot

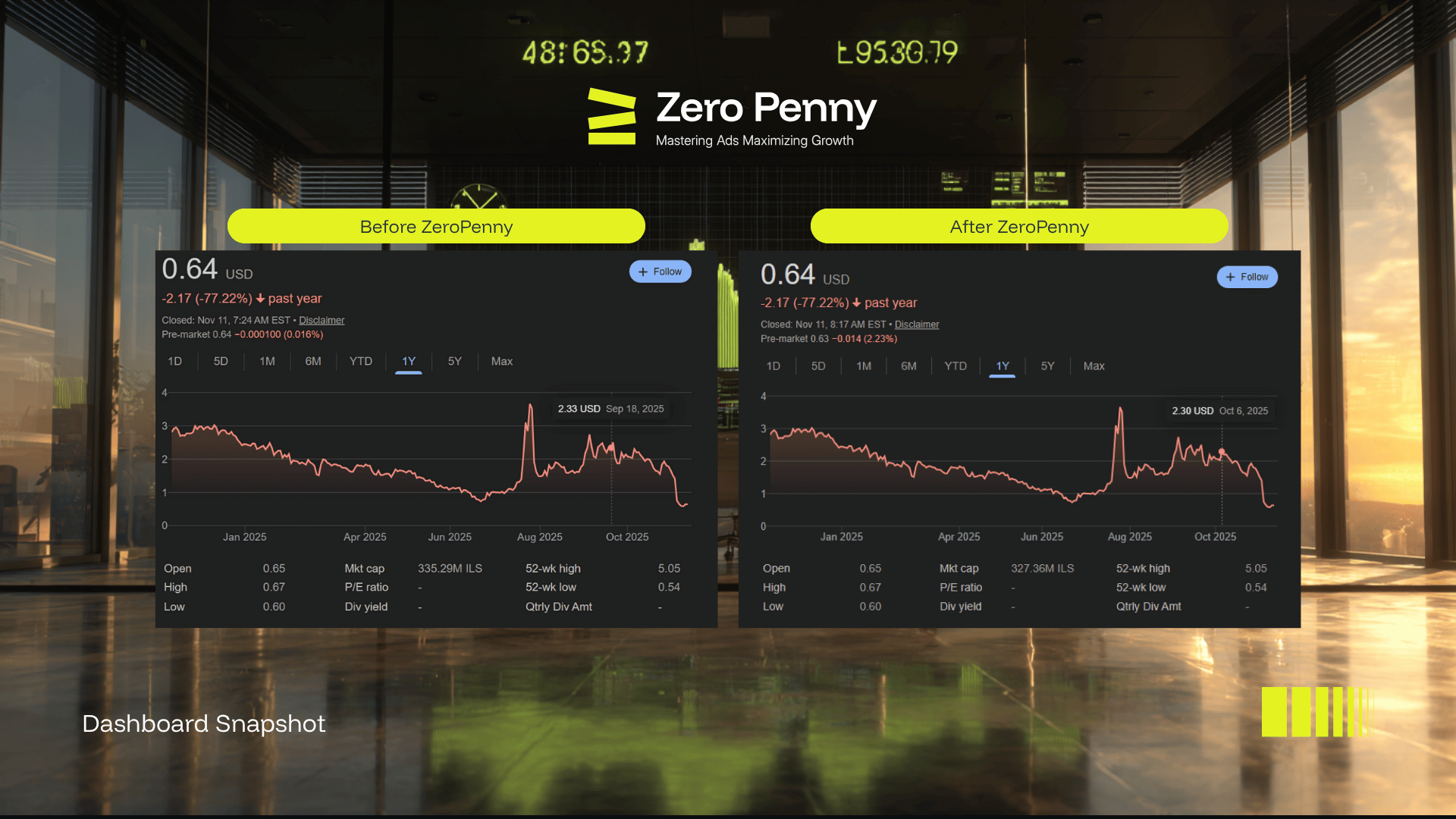

Liquidity Metrics (Window)

Trading Volume: $20.6M

Avg Daily Activity: ~$2.06M

Volume Behavior: Uplift aligned with ad-delivery periods

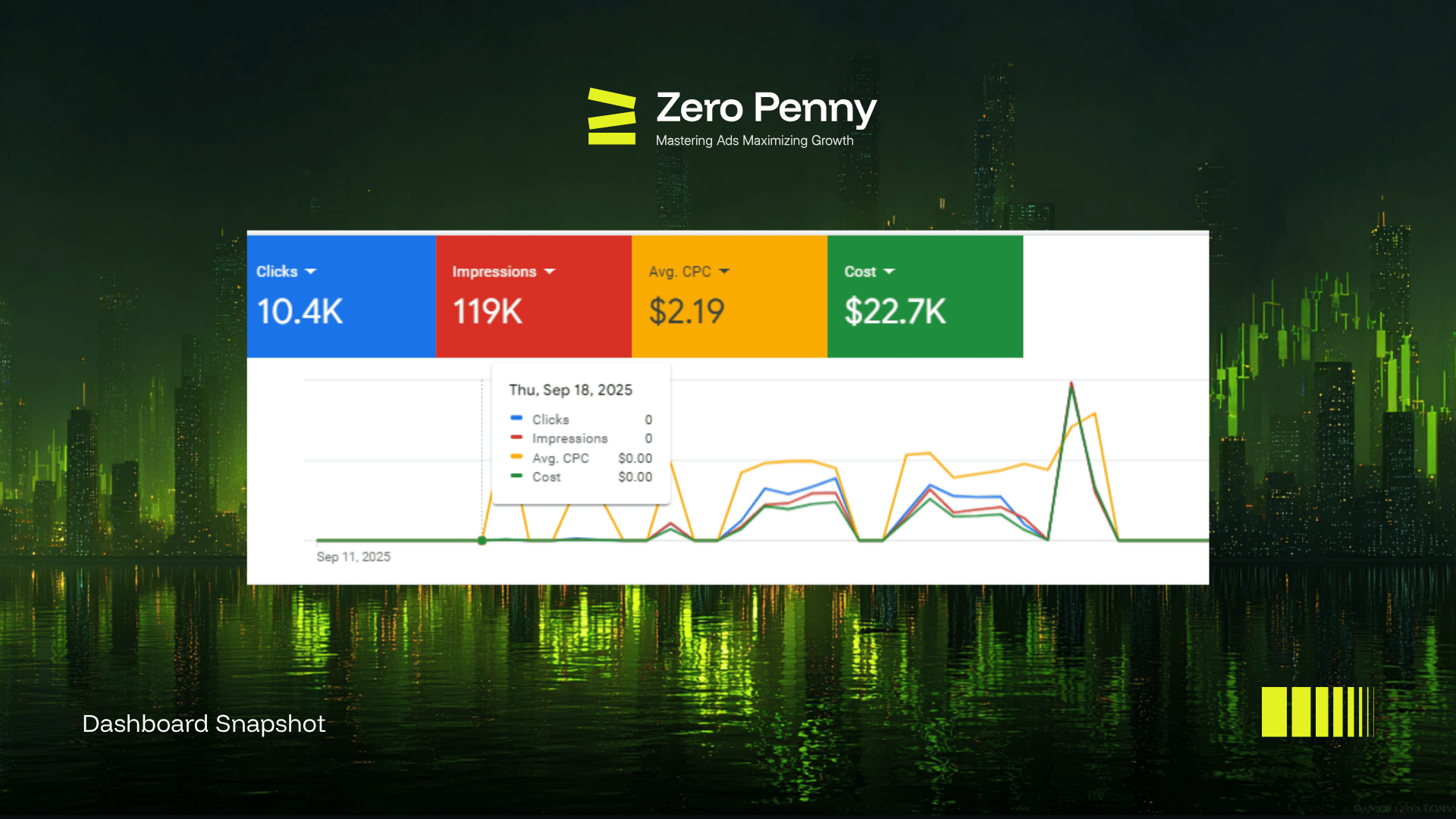

Google Ads Metrics

Clicks: 10,400

Impressions: 119,000

CTR: 8.7%

Avg CPC: $2.19

Cost: $22,700

Primary HVAs: brokerage redirects • watchlist adds

Causality & Interpretation

Markets are multi-factor. We don’t claim sole causation. But the alignment between ad delivery windows and investor-behavior spikes (HVA + trading volume) suggests the campaign was a material input in attention formation and participation — without violating compliance or making speculative statements.

Quick Benchmark (Context Only)

Prior case: 150% price surge and $7.7M market cap boost

This campaign: $20.6M liquidity generated for a listed company under stricter compliance and pacing

System evolution: market-hours pacing • HVAs • server-side events → cleaner causal patterns

Key Learnings

Timing Beats Volume: market-hour delivery correlates with HVA density

Intent Stratification Works: layering keywords lifted CTR vs. generic clusters

Data Integrity Wins: server-side tracking preserved signal clarity

Causality Awareness = Edge: isolating ad-driven attention windows increases reliability

The Outcome

In 14 days, the system delivered:

10,400 precision clicks

$20.6M in trading volume

Zero compliance violations

Verified investor-behavior shifts (brokerage redirects • watchlist adds)

The ZeroPenny Standard

We don’t chase volatility — we engineer systems that produce measurable investor intent. Our Google Ads architecture is built for attribution, resilience, market synchronization, and liquidity impact. When campaigns move with market logic, liquidity becomes the clearest proof of engineered attention.

If you operate in gambling or any restricted vertical, let’s talk. We build policy-first lead engines that scale without sacrificing safety or speed.

1-tap message us:

Subscribe to get insider case studies, real dashboards, and breakdowns of how we scale lead gen in the hardest niches.

Join free — or upgrade for exclusive deep dives.

Related Case Studies

🔹 This ‘Unstoppable’ WhatsApp Funnel Survived Gambling — and Just Crushed IPTV: 476 Leads at $3.64

How we adapted a gambling-proof funnel to scale IPTV sales with zero bans.

🔹 How We Generated 1,000+ IPTV Signups on Meta Ads (Italian Campaign)

The system behind Italy’s highest-converting IPTV signup campaign.

🔹440+ Finance Leads at $12.80 — How Zero Penny Did It Without a Landing Page

How we generated high-intent finance leads using form-based funnels and zero-page friction.

🔹1800+ Signups, $1+ Cost, and Strong FTDs – The Edge Every Casino Needs

(duplicate — left intentionally in case it’s needed in two locations)

🔹10,556 Targeted Leads at 1/14th the Average CPC

A complex, multi-platform campaign that delivered results in a heavily restricted vertical.

🔹2,771 Debt-Relief Leads from Latin America — With $0 Wasted

How we navigated Meta’s restrictions to drive thousands of verified leads for a financial product.

🔹GVF: The Funnel Behind 900+ WhatsApp Leads in Blackhat Finance

How we created a lead-gen machine for a blackhat vertical, delivered on WhatsApp without bans.